are raffle tickets tax deductible australia

Donating to those in need directly. You cannot claim a deduction for a purchase for example raffle tickets.

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball

Are season tickets tax deductible 2021.

. The IRS considers a raffle ticket to be a contribution from which you benefit. 37 out of 38 found this helpful Comments 0 comments. Was this article helpful.

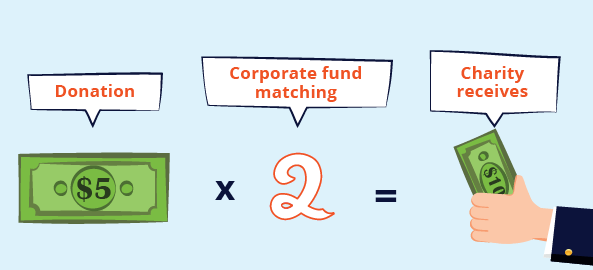

If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater. This means that purchases from a charity that involve raffle tickets items or food cannot be claimed as tax deductible gifts. For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the donation.

Unfortunately support via our raffle games are not tax deductible. What qualifies as charitable donation. For specific guidance see this article from the Australian Taxation Office.

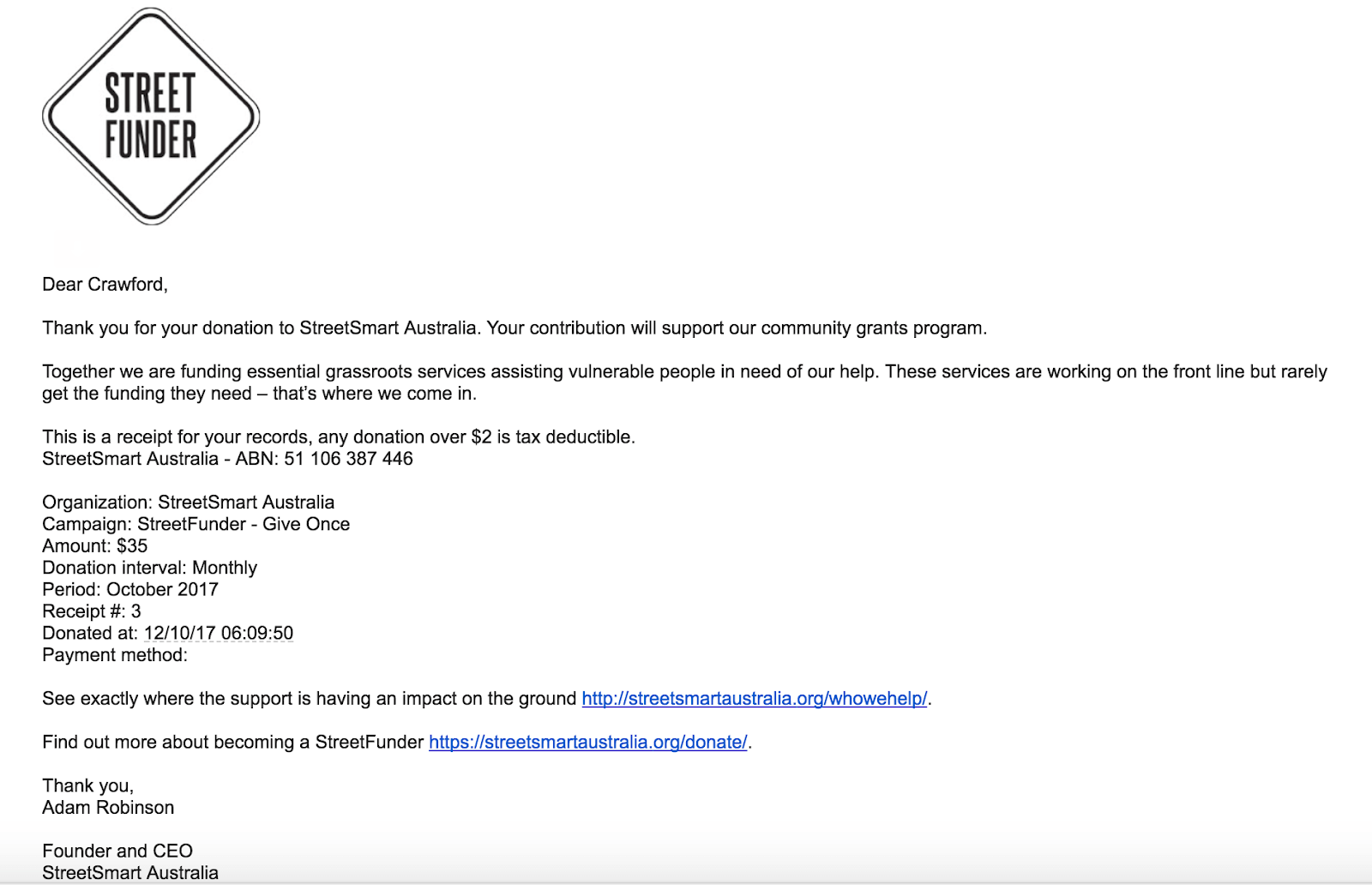

To claim tax deductible donations on your tax return your donation must be. Donations currently are not tax deductible so please be aware of this. This is because as far as the ATO is concerned youre not giving a no-strings-attached donation as you can potentially receive something in return.

What you cant claim You cant claim gifts or donations that provide you with a personal benefit such as. Are Facebook fundraisers tax-deductible. If you get something in return for your donation such as a raffle ticket thank-you card or ribbon its not considered a gift and you cant claim it.

A gift is voluntary and the donor must not receive any material benefit in return the ATO spokesperson says. Are Gala tickets tax deductible. A spokesperson for the ATO says you can only claim tax deduction on gifts.

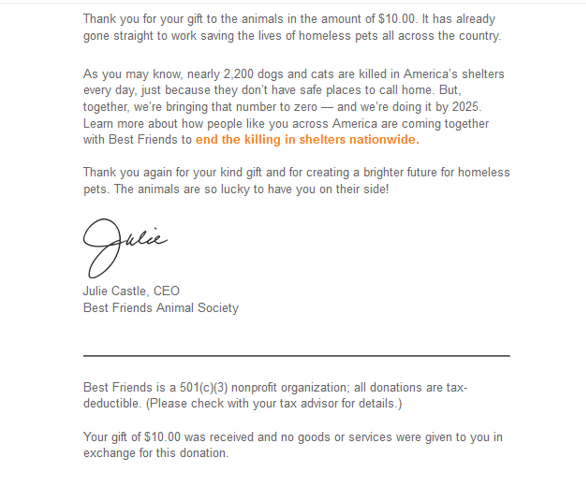

You must also keep proof in the form of a receipt or bank statement of any donation you make as well as the total dollar amount of all donations you make in a tax year. Raffles are considered contributions to which you benefit by the IRS. There is the chance of winning a prize.

This is because the purchase of raffle tickets is not a donation ie. In accordance with Australian Tax Office guidelines if you receive a lottery ticket in return for your transaction then your purchase cant be claimed as a deduction. Updated No lottery tickets are not able to be claimed as a tax deduction.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. On top of that its important to. Even if you buy some raffle tickets to support a reputable charity these cant be claimed on tax.

Why are my charitable contributions not deductible. When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their contribution as a tax deduction. Made to a deductible gift recipient charity and.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Raffle or art union tickets for example an RSL Art Union prize home items such as chocolates mugs keyrings hats or toys that have an advertised price. Are office snacks deductible 2020.

Any donation that meets this criteria is considered a tax deductible donation which means you can deduct the amount of your gift from your taxable income on your tax return. If you would prefer to make a tax-deductible donation you can by asking during a raffle sales call or using your states RSPCA website donation page links at the bottom of the page. Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible.

Can You Write Off Charity Raffles. Raffle Tickets may not be deductable when sold as charitable gifts from nonprofit organizations even if its in the nonprofit organizations name. 25 Jul 2017 QC 46264.

Are raffle tickets tax-deductible Australia. Lottery or raffle tickets. To claim a deduction you must have a written record of your donation.

Raffle tickets are only transferable or assigned to people according to the terms of their ownershipAll raffle tickets are final and no refunds will be made if a mistake was made in salesThe value of raffle tickets purchased does not contribute to the tax deduction. To qualify for a deduction the contribution must meet all the conditions for a tax deductible contribution.

Tax Deductible Donations An Eofy Guide Good2give

Complete Guide To Donation Receipts For Nonprofits

How To Claim Tax Deductible Donations On Your Tax Return

Common Tax Issues Associated With Making Donations Wolters Kluwer

Are Raffle Tickets Tax Deductible The Finances Hub

Complete Guide To Donation Receipts For Nonprofits

Are Raffle Tickets Tax Deductible The Finances Hub

How To Claim A Tax Deduction On Christmas Gifts And Donations

Complete Guide To Donation Receipts For Nonprofits

Are Raffle Tickets Tax Deductible The Finances Hub

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Tickets Raffle Auction Fundraiser

Are Lottery Tickets Tax Deductible In Australia Ictsd Org

How To Know If Your Charitable Donations Are Tax Deductible

![]()

Donations And Deductions Bishop Collins

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Are Raffle Tickets Tax Deductible The Finances Hub

Tax Deductible Donations Reduce Your Income Tax The Smith Family

Silent Auction Ideas Donation Ideas Its Fun Diy Silent Auction Donations Auction Donations Silent Auction